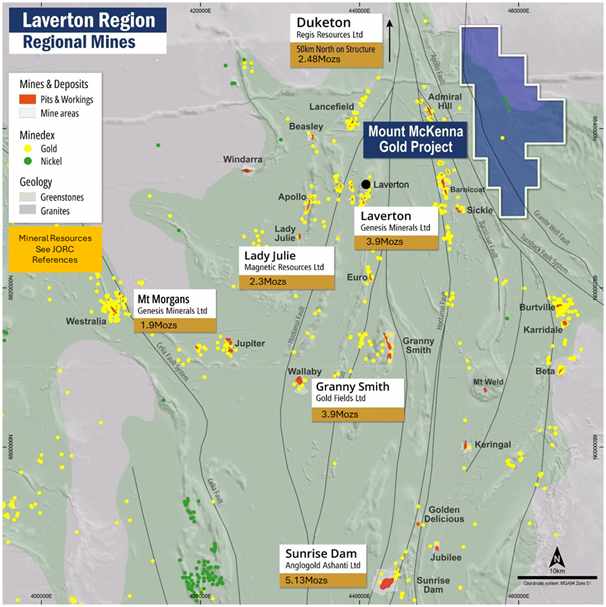

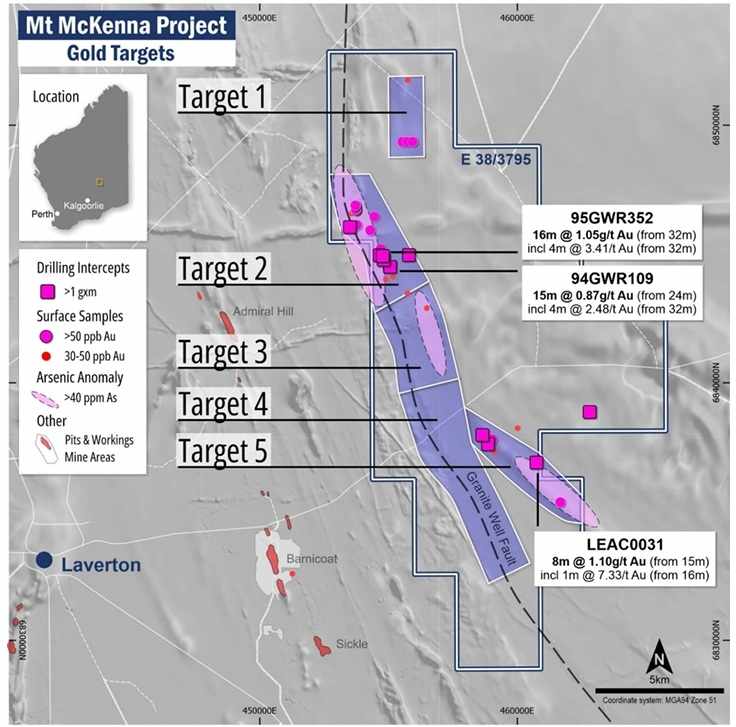

The Xanadu divestment provides Platina with several strategic benefits. Firstly, it frees up capital and management attention to focus on the Mt McKenna Gold Project. Secondly, it maintains upside exposure through performance payments and royalties, ensuring that Platina can benefit from future discoveries without operational responsibilities.

The transaction also strengthens the company’s balance sheet, allowing for accelerated exploration programs and potential acquisitions in the Laverton region. By aligning resources with high-value opportunities, Platina enhances its ability to generate sustainable shareholder returns and long-term growth.

Additionally, the divestment mitigates risk by transferring operational responsibility to a company with established expertise in the region. Kalamazoo Resources’ experience in the Pilbara enhances the likelihood of successful development at Xanadu, which indirectly benefits Platina through retained interests.

Overall, this strategic decision reflects a proactive approach to resource management, ensuring that Platina remains focused on high-potential projects and is well-positioned to capitalize on favorable market dynamics in Australia’s gold sector.

Write a comment ...